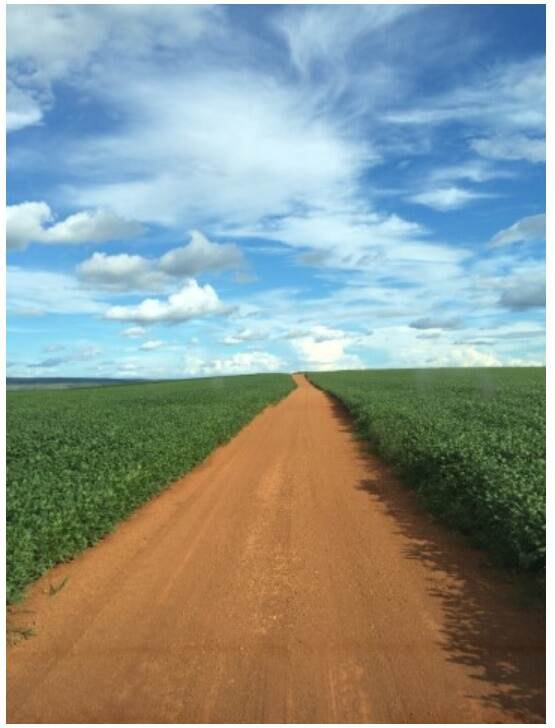

Brazilian agriculture in 2024 faced challenges and climate vulnerability

In 2024, Brazilian agriculture faced significant challenges, from declining global demand and high input costs to extreme weather events linked to El Niño. While overall production saw only a modest decline, the sector's vulnerability to climate change became increasingly evident. At the same time, government support reached record levels, new export markets opened, and Brazil achieved notable milestones in trade and sustainability. This article looks back at the key developments that shaped Brazilian agriculture over the past year.

Farmers faced challenges:

- Global demand slowed, reducing prices for key crops like soy and corn (especially demand for corn from China declined).

- High input prices, exacerbated by a weaker Brazilian Real, squeezing profit margins.

- El Niño-related droughts and floods in critical production areas disrupted harvests.

Despite these headwinds, overall agricultural production and soy exports experienced only a modest decline. Soy exports to China even increased.

Supporting farmers

To support farmers, the government's 2024-2025 Plano Safra budget reached a record BRL 400 billion (approximately EUR 64 billion), a 10% increase over the previous season. Furthermore, over 200 new markets in over 60 countries opened for Brazilian agricultural products, according to government reports.

Vulnerability Brazilian agriculture

The vulnerability of Brazilian agriculture to climate change became evident in 2024:

- Rio Grande do Sul experienced the wettest April and May on record, impacting over 206,000 rural properties.

- Concurrent droughts in other regions, particularly impacting the Amazon and the coffee production in Minas Gerais.

- Brazil recorded a 150% increase in burned land compared to 2023, with 22.38 million hectares affected between January and September.

In additional developments:

- The Brazilian Presidency of the G20 Agriculture Working Group succeeded in adopting a ministerial communiqué on trade, climate/environment, family farming and fisheries.

- Brazil surpassed the United States as the world's largest cotton exporter, with 2.7 million tons shipped compared to the US's 2.4 million tons.

- Brazil enacted the first-ever law regulating bio-inputs, streamlining their approval process and encouraging on-farm production. The Brazilian bio-input market is now valued at EUR 1 billion annually.

- The agriculture ministry (MAPA) launched AgroBrasil+Sustentavel, an online platform to help Brazilian producers respond to requirements such as the EU Deforestation Regulation. MAPA also announced individual identification of cattle by 2032.

The outlook for 2025 is more optimistic, with a 10% increase forecast in grain, bean, and oilseed production, reaching 323 million tons compared to 293 million tons in 2024. Input prices remain a challenge, depending also on the currency exchange rate.