Uptrend in Bulgarian land prices has paused in 2024

Decreases of 10-20% are even observed in many key agricultural areas of the country

Supported strongly by CAP subsidy inflows, abundant crops, rising commodity prices and profitability, higher rents, along with growing speculative investment interest, arable land prices in Bulgaria increased significantly in a firm trend since the EU accession in 2007. However, in 2024, with economic uncertainties and slumping grain and oilseed prices, Bulgarian land marked has seemed to cool off and even stepped back.

The official statistics for 2024 will be released in early 2025, but our observations are of a decrease in agricultural land prices. It is difficult to generalize how big the price decrease is, but there are places where it is around 20%, and in others it is below 10%, says Evgeniy Orashakov, Chairman of the Management Board of the Bulgarian Association of Agricultural Land Owners (BAALO) in an interview for Agri.bg (BG)

Driving factors

There are many factors that influence the price of agricultural land, but the main one in the last year has been uncertainty. Uncertainty in all its dimensions – political instability in Bulgaria, the war in Ukraine and its impact on geopolitics in the region and on the markets for grain and oilseeds, high inflation in recent years, Orashakov adds.

According to him, the direction of future development of the Green Deal in the European Union is questionable with EU most likely to also postpone the implementation of the Deforestation Regulation. Orashakov expects the central topic to be the impact of the Green Deal on competitiveness of European agriculture, compared to that in other countries of the Black Sea region, the US and South America.

Orashakov also points out that there are also discrepancies in expectations of market players with some sellers anticipating the price increase trend of the last ten years to continue and having unrealistic price targets, while in the same time, buyers are reluctant to complete deals, given the instability, uncertainty and lack of perspective in the current economic and political environment.

Demand for green energy investments

Orashakov is of the opinion that the growing number of green energy investments, especially solar, does not significantly affect agricultural land market dynamics.

First of all, the investment interest in construction of facilities for electricity production from renewables concerns a very small volume of the land fund. It is no more than 0.1-0.2% of the land with agricultural purpose, or about 5-10 thousand ha out of over 5 million ha agricultural land in total. Other factors also play a role, such as the specific location of the terrain, slope, category of the land. In principle, in view of the rules for changing the purpose of agricultural land, renewables can only be built on terrain with low fertility qualities from category 7 and above. There is no way that such a limited niche, with so many specifics, can seriously affect market interests in agricultural land - Oreshakov explains.

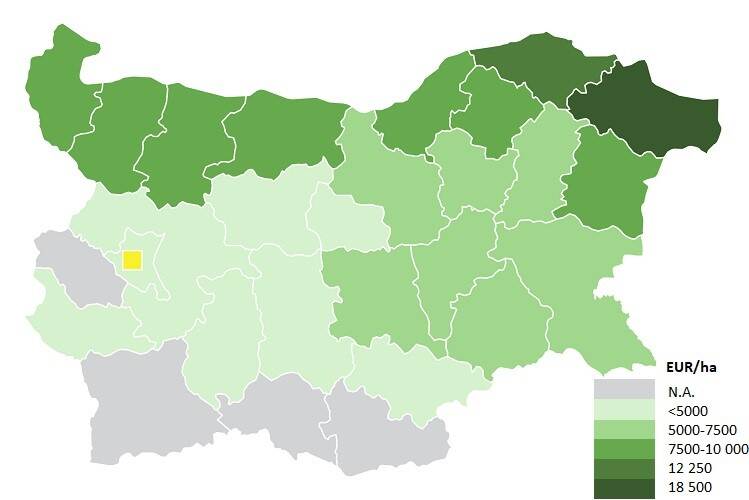

Land prices map (2023)

With its diversity of soil types, climate conditions, economic environment and level of infrastructure, Bulgaria has also quite varying land prices, even within the borders of a same region. They range mostly between 5000 and 10 000 euro on average per ha of good-quality arable land. Dobrich (18 500 eur/ha) and Silistra (12 250 eur/ha) regions being outliers with their large plots of fertile black soils, famous for their grain production and in close proximity to the key export Varna port. Despite the rapid growth in Bulgarian arable land prices throughout the last decade, they remain significantly lower compared to other key agri-food EU member states.