The European and Polish pork markets

Despite a slight decline in the overall swine population, Poland's pork industry is showing signs of recovery. The country has seen an increase in breeding sows and piglets, which is expected to boost pork production and exports in the coming months. While domestic pork consumption remains stable, Poland has been actively exporting its pork products to both EU and non-EU markets.

European market

The European Commission predicts a revival of the pork market in the European Union in the second half of 2024. Although a December 2023 survey showed a slight decrease (0.6%) in the overall swine population to 133.6 million head, the number of breeding sows increased by 1.6% to 10.6 million head (an increase of 170,000 head), signaling a potential recovery in the swine population after three years of significant declines. The number of piglets also increased by 2.9% to 40.7 million, which is likely to be reflected in an increase in slaughter volumes in the second half of 2024.

According to Eurostat data, pig slaughter in the EU in the first quarter of 2024 exceeded 5.4 million tons and was slightly higher than the previous year. If the ASF situation does not change radically, the European Commission's short-term forecast published in May 2024 predicts that pork production in the EU in 2024 will decline slightly to 20.7 million tons. At the same time, pork consumption is expected to remain stable (around 31 kg per capita) due to the still high prices of live animals.

Pork exports

In Poland, the increase in pig slaughter in the first months of 2024 contributed to improved export results. In the period from January to April 2024, 205,000 tons of live animals, meat, processed products, and pork fats (in carcass equivalent) were sold abroad, which is 3.7% more than a year earlier. Revenues from the sale of pork products abroad increased by 6% to 669 million euros (2.9 billion zlotys).

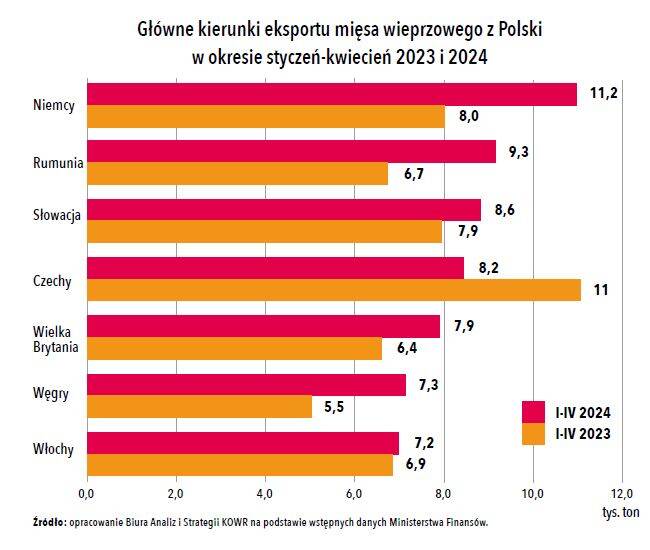

In the product structure of Polish pork exports, meat had the largest share, accounting for over half of the sold volume (57%). From the beginning of January to the end of April 2024, 109,000 tons of pork (in product weight) were sold abroad, which is 8% more than a year earlier. The European Union was the recipient of about 75% of the pork volume, mainly:

- Germany (11 thousand tons, 10%)

- Romania (9 thousand tons, 9%)

- Slovakia (nearly 9 thousand tons, 8%)

- Czech Republic (8 thousand tons, 8%)

- Hungary (7 thousand tons, 7%)

Among non-EU countries:

- Great Britain (8 thousand tons, 7%)

- USA (4 thousand tons, 4%)

- Hong Kong and Vietnam (about 3 thousand tons each, 3%).

Polish pork production

In Poland, the swine population in December 2023 reached over 9.8 million head, which is 1.5% more than in December 2022. Similar to the EU, the increase occurred in:

- Swine for fattening weighing 50 kg and over - an increase of 11.9%

- Specifically, pregnant sows - an increase of 12.8%

- The piglet herd increased by 6.1%

- Weaners - an increase of 1.7%

- However, the slaughter pig herd decreased by 2.1%.

As a result of the increase in the herd, deliveries of live animals to slaughterhouses also increased in the first months of 2024. In the period from January to May 2024, industrial pig slaughter amounted to 806,000 tons in hot carcass weight (1,032,000 tons in live weight), which is 9% more than the previous year.

Import

Imports of pork products to Poland have been higher than exports since 2008. In the first four months of 2024, a total of 317,000 tons of live animals, meat, fats, and pork products (in carcass equivalent) were imported into the country, which is 5% more than a year earlier. At the same time, expenditures on the purchase of pork products increased by 13% to 961 million euros (4.2 billion zlotys).

The country imported mainly pork and live pigs, almost entirely from EU countries. From January to the end of April 2024, 221,000 tons of pork (in product weight) were imported into Poland, which is 2% more than a year earlier, mainly from:

- Denmark (57 thousand tons)

- Belgium (46 thousand tons)

- Germany (43 thousand tons)

- Spain (30 thousand tons)

- The Netherlands (24 thousand tons)

Imports of live pigs to Poland in the period from January to April 2024 were 14% higher than the previous year and amounted to 2.6 million head, of which 2.4 million head were piglets and weaners from Denmark (98% of the volume). Small quantities were imported from Latvia (21 thousand head), Hungary (9 thousand head), and Germany (5 thousand head).

Pork prices

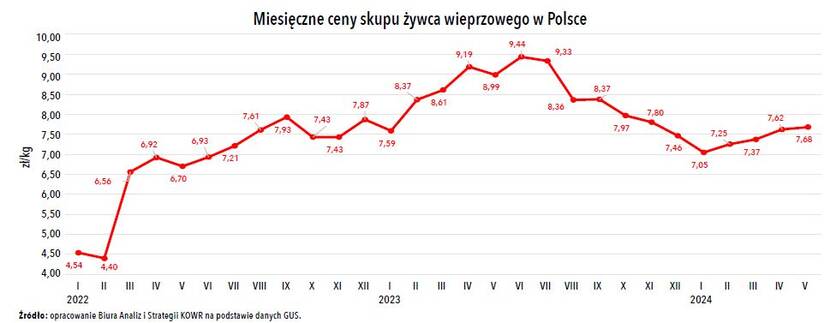

Since February 2024, both in the EU and in Poland, pig procurement prices have been increasing. In Poland, they are still lower than in the second and third quarters of 2023, when they were in the range of 8.36-9.44 zlotys/kg. In May 2024, domestic suppliers received an average of 7.68 zlotys/kg for slaughter pigs, which is almost 1% more than in the previous month but 14.5% less than in May 2023.

At the beginning of June, pork prices showed a moderate increase. However, in the second and third decades of the month, prices fell. According to data from plants covered by the Ministry of Agriculture and Rural Development's Integrated Agricultural Market Information System, in the period from June 17 to 23, 2024, pigs were purchased on average at 7.54 zlotys/kg. This was 0.6% lower than the level obtained a month earlier and 18% lower than a year earlier.

Source: KOWR