Overview of Dutch agri-food export to South Korea in 2024

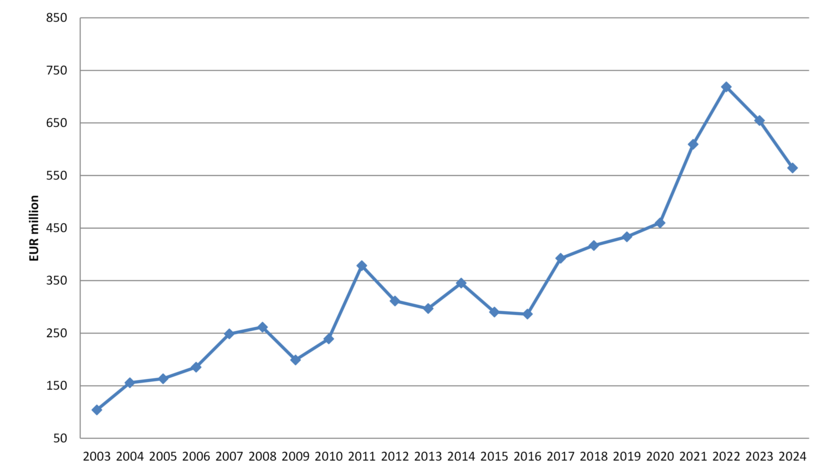

Dutch agri-food exports to South Korea showed a decline in 2024, with a total export value of EUR 564 million, a decrease of 13.8% compared to the previous year. The South Korean won (KRW) experienced a significant depreciation of approximately 11% against the US dollar throughout 2024, reaching a level not seen in 15 years. The won’s depreciation made imports more expensive, contributed to the economic slowdown, and reduced agri-food exports from the Netherlands to South Korea.

The agriculture team at the embassy of the Netherlands in Seoul monitors the trade between the Netherlands and South Korea and, when necessary, facilitates the businesses, removing trade barriers. Each year an overview of the exports is provided to assist the companies and highlight the rising opportunities in South Korea for Dutch companies. It is thereby important to emphasize that the importance of technology exchange and export of high-tech technology has increased, as the agriculture team at the embassy seeks to boost the resilience and sustainability of the local South Korean agri-food system.

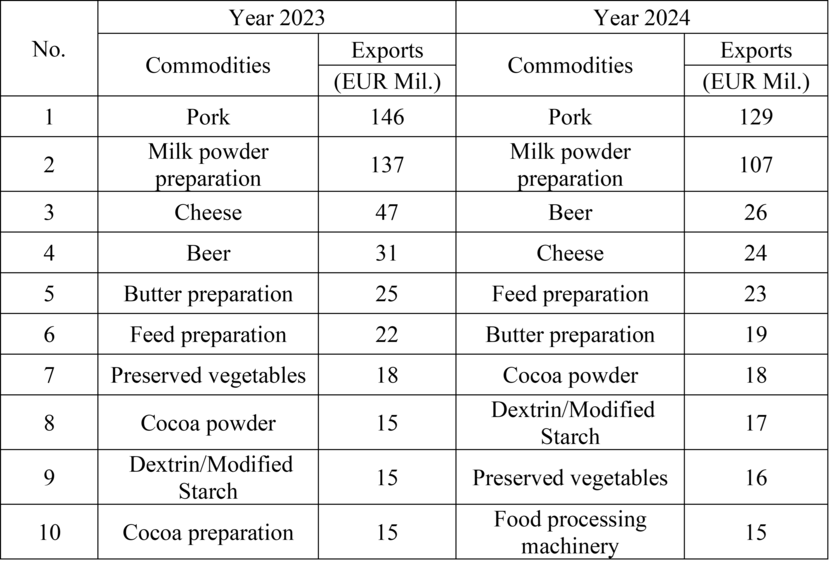

The largest agri-food export commodity in 2024 was pork, followed by milk powder preparation, beer, cheese, feed preparation, and butter preparation. Pork and milk powder preparation were ranked in the third and 5th places respectively by export value among all the trade commodities, including non-agricultural products exported from the Netherlands to South Korea.

Fig.1 Agri-food exports from the Netherlands to South Korea by year

Table 1. Top 10 Dutch agri-food commodities exported to South Korea in 2023 and 2024

Pork

Dutch pork exports decreased in 2024 due to the Korean won depreciation and the economic slowdown. The resumption of pork exports from Germany, which had been suspended due to African Swine Fever, also contributed to a decline in Dutch exports. The Netherlands was the 6th largest exporter of pork to South Korea after the US, Spain, Canada, Chile and Germany. Since German pork exports were suspended again due to an outbreak of Food and Mouth Disease in January 2025, Dutch pork exports are expected to increase in 2025. Around 87% of pork exported from the Netherlands to South Korea was frozen pork belly (called Samgyeopsal in Korean), primarily used for Korean BBQ. Local pork is generally twice as expensive as imported pork, but Korean consumers prefer local products. As a result, local pork is typically sold in retail stores, while imported pork is mainly supplied to restaurants.

Milk powder preparation

Dutch milk powder preparation exports also decreased in 2024. Milk powder preparation is a blend of milk and whey powder created to lower customs duties when exported to South Korea. Due to the economic slowdown and declining dairy consumption, local dairy processors had been struggling with overproduction of raw milk since the 2nd half of 2023. They had to dry leftover raw milk to make milk powder, which then competed with milk powder preparation from abroad.

The Netherlands is the largest exporter of milk powder preparation, accounting for 61% of the market. As local raw milk in South Korea costs more than twice the world's average raw milk, the demand for high-quality dairy ingredients from abroad is high. The Netherlands has a good name in the Korean market for its high-quality dairy chain. Dutch milk powder preparation is mainly used in the Korean dairy and confectionary sectors.

Protein products were becoming popular among adult consumers for diet, sports, and immunity. South Korea increasingly imported Dutch milk powder products, such as whey protein, goat milk protein, and lactoferrin, as raw materials for the protein products.

Fig.2 Pork and milk powder preparation exports from the Netherlands to South Korea by year

Beer

The value of Dutch beer exports decreased slightly in 2024, with the Netherlands maintaining its position in 2nd place in the Korean market after Japan, accounting for 14% of the market. It is noteworthy that the market share of Japanese bear grew from 25% in 2023 to 33% in 2024. The improved relationship with Japan is considered to be one of the reasons for this growth.

Cheese

The total value of cheese imports to South Korea in 2024 decreased by 33% and returned to 2020 levels. Dutch cheese exports saw a more drastic decline of 48%. Among the cheese products exported to South Korea- Gouda cheese, Mozzarella cheese and processed cheese- Mozzarella cheese was most impacted, dropping by 71%. As a result, the Netherlands became the 8th largest exporter of cheese, three ranks lower than the previous year.

Others

In spite of the overall decline of agri-food exports from the Netherlands to South Korea, exports of feed, starch, cocoa products, hi-tech agricultural machinery, seed and sauce continued to grow.

Due to political uncertainty, the depreciation of the won seems unlikely to return to normal levels by the first half of the year. However, if the economic and political situation stabilizes in the second half of the year, trade may have the opportunity to turn around.

The agriculture team at the embassy of the Netherlands in Seoul will organize a Dutch Pavilion in the Seoul Food 2025 from June 10th to 13th, 2025, to promote high-quality, sustainable Dutch food products.

For more information about the Seoul Food 2025: SEOUL FOOD

For signing up, please email SEO-LVVN@minbuza.nl