Spain: The never-ending dairy crisis

Four years after the signing of the “Agreement on the Stability and Sustainability of the Dairy Sector”, the measures implemented have not been sufficient to bring the Spanish sector out of the crisis.

In September 2015, initiated by the Ministry of Agriculture, several stakeholders signed the so-called “Agreement on the stability and sustainability of the dairy sector’s value chain”. The signatories were two of the three national farmers’ organizations, the association of agro food cooperatives and Fenil, the sectorial organization representing the dairy industry.

The purpose of the agreement was to provide stability, sustainability and greater value creation to milk thorough the chain, resulting in better prices and more remunerative in each segment of it.

The assessment carried out by the ministry reflects an improvement in the number and quality of business contracts. The implementation of other measures, such as the obligation by law to label the origin of the milk in all packaging, has also helped to increase milk value in Spain.

However, the sector’s assessment is a bit different. In general, it is agreed that, despite some progress, a greater impact was expected, as the major problems affecting the sector have not been solved: the low prices that farmers get and with which they do not cover costs and the continued closure of farms. This situation has led the sector’s future to be in doubt, because the lack of profitability and attractiveness makes it difficult for young people to join it and, consequently, to take over from one generation to the next.

The manager of the sectorial organization Fenil is something more positive because “regardless the fact we all aimed more, in the midst of the European sector crisis, we achieved a certain stability in order to avoid the destruction of our productive and industrial fabric. It has also served to raise awareness throughout the chain”. He also believes that “at that time, the agreement only referred to liquid milk and now it would be a good example for other products as cheese”.

Prices still do not go up

Farmers have not saw much of the agreement’s effects, especially with regard to the revaluation of the price they receive per liter of milk delivered to processing industries. It was only noted at the beginning and that is why “the decrease in the number of farmers has not been prevented from keeping at around 5% per year”, farmers’ organizations report.

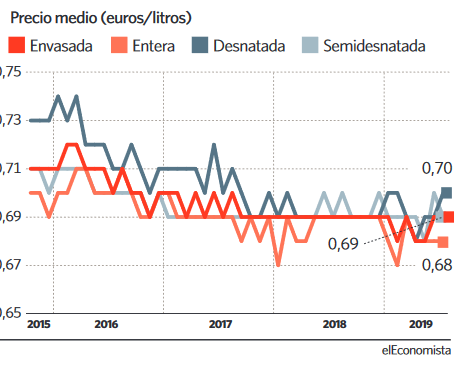

According to them, “prices at farm gate are between 7 and 13% below the European average. Prices range from 0.28 to 0.32 euros per liter and production costs do from 0.34 to 0.37 euros”. Fig. 1 shows the evolution of the average price, by type of milk, paid by the consumer.

More milk in fewer farms

In these four years, the Spanish sector has gone from a production of around 6 million tons (the ceiling established by the milk quota) to almost 7.2 million at present (8 million tons including the sheep and goat production). This growth, together with prices below those in other European countries, to which transport costs should be added, has placed the Spanish raw material in an advantageous position.

On the other hand, the number of milking cows continues to decrease and there were just over 800,000 in 2018. Production takes place in fewer farms “due to the lack of profitability”, farmers say. The processing industry organization points out that “this is something happening all over Europe”. However, it is also truth that some medium-size farms are closing because the lack of generational replacement.

Challenges ahead

All parties agree that the agreement needs to be revised next year in order to boost the sector. There is a call to involve the retail sector too, as well as “to fix a reasonable price at farm gate”. Farmers are also asking that the environmental and animal welfare-related costs should not fall on them alone.

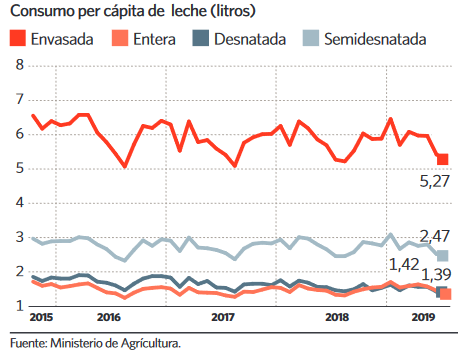

Another pending challenge is to recover the consumption of milk; between 2010 and 2018, liquid milk consumption fell by 10% (Fig. 2).

A consumption recovery must be also supported by increased exports and by acting in cooperation with the retailers.

Source: Eleconomista.es