The Hungarian food industry could be promising sector for investments

The Hungarian food industry has been expanding steadily in recent years. Food industry enterprises are capable of continuously modernizing production procedures, adapting themselves to market demands and providing high-quality products for customers.

Hungary’s food industry has had to face various challenges in the past decades. The regime change in 1990, the opening of the county’s market required for EU accession and the global economic crisis have created some major hurdles for the sector. It has to be noted though that even the global economic crisis could not derail the industry; it could remain stable and continue to be a net food exporter.

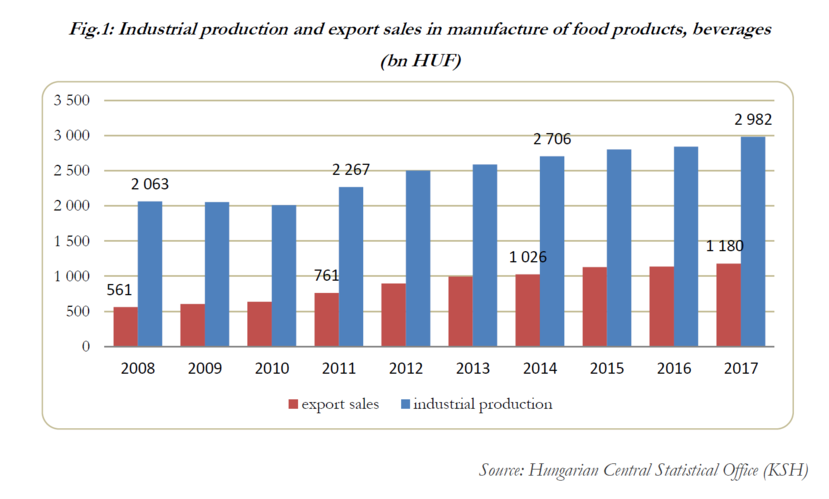

Since 2010 the sector’s output has been steadily on the rise. In 2017, the value of output was up by 4.8 percent year-on-year, totaling HUF 2982bn (EUR 9.3bn) which accounts for 10 percent of total industrial sector output.

The share of exports within the total value of output has reached 40 percent in 2017.

The category food, beverages and tobacco products plays a key part in Hungary’s external trade (more than 7 percent). The main items which improved the balance were cereals and cereal products, meat and meat products as well as livestock feed.

In the first half of 2018 the main driver of the increase of export value was meat products (poultry at first place), livestock feed, food products and beverages, while the export value of cereals and cereal products declined in real terms.

Within the food industry, the category with the highest share of companies (21 percent) are the producers of bakery products and pasta, ahead of the following groups with shares of 8-9 percent: producers of fruit and vegetable products, meat products, dairy products and other food products. The food industry comes as the second largest employer among manufacturing sub sectors.

According to a survey conducted by the Research Institute of Agricultural Economics with the participation of 574 food industry enterprises, in 2017 the value of investment in the food industry was up by 65 percent year-on-year. These altogether accounted for 44 percent of the total volume of food industry investment.

The food industry was identified as a priority area in Hungary’s re-industrialization blueprint, aiming to boost output, increase competitiveness and bolster market position. To this end, enterprises operating in the sector have received massive support in recent years. Funding was available for SME’s and large companies aiming at increasing their competitiveness.

Although the export value has grown in the recent years, the major share of the Hungarian export still consist of raw materials and unprocessed food. After the EU accession Hungary used EU funds on managing social inequalities and opening up rural areas, meanwhile in the common internal market its food industries have lost their competitiveness and most of them closed. By exporting unprocessed goods the country loses income and by now became one of the EU’s raw material supplier in food sector. As the country faces consequences of its former decision on allocating subsidies, currently trying to favor more to processing industries. But it will take years to make up leeway therefore there are still many opportunities for market players who would invest in this sector.

Examples of successful Dutch companies producing consumers foods & beverages in Hungary are FrieslandCampina and Heineken and feed additives manufacturers Agrifirm and DSM.