Ethiopia's coffee crisis: navigating EU regulations amid sustainability challenges

Ethiopia's coffee sector confronts significant hurdles due to the European Union's Deforestation Regulation (EUDR). This regulation, crucial for combatting deforestation, could potentially disrupt Ethiopia’s economy where a third of the export earnings stem from coffee, primarily sold to the EU. That is why the government, along with international development partners, has rallied to devise strategies that safeguard both the environment and the livelihoods dependent on coffee.

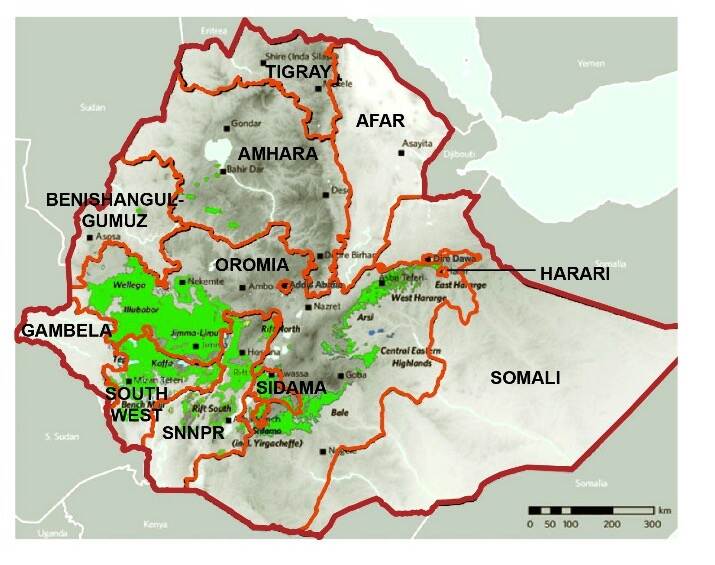

In Ethiopia, the EUDR will have a detrimental effect on the economy if its negative impact is not managed well. Around one third of the country’s export earnings come from coffee. It is the main source of foreign exchange, and the European Union (EU) is the largest market with around 30% of Ethiopian exports going there.[1] Most Ethiopian coffee is grown in forested areas, where trees create the ideal shade conditions for coffee to grow. This is much less damaging than the monoculture plantations that are seen in other countries. Nevertheless, cutting down primary forest to make way for coffee trees does occur in some areas in the country. The EUDR can lead to coffee producers avoiding expansion into forested areas.

The main challenge for the Ethiopian coffee sector is that its coffee is mainly grown by around 5 million smallholder farmers. Most of them are low-income and lack the expertise or resources needed to collect complex data for proving their EUDR compliance. In addition, coffee supply chains are complex and fragmented, often involving several brokers. One single shipment of coffee can include beans from thousands of farmers.[2]

‘The main challenge for the Ethiopian coffee sector is that its coffee is grown by around 5 million smallholder farmers’

Slow brew: Ethiopian Government finally unveils a plan for EUDR compliance

This makes Ethiopian coffee risky in the eyes of buyers. That is why European companies have stopped buying coffee from Ethiopia and have shifted to countries with better traceability and compliance systems.[3] As a result, the income of these small farmers has dwindled. Also, the need to farm sustainably has decreased.

The Ethiopian Government has developed an action plan to address EUDR compliance for the coffee sector, stipulating needed activities and possible implementing organizations.[4] Recently, the plan has been approved nationally and shared with the EU delegation based in Addis Ababa. The document has been submitted to the EU along with a request for an extension of the EUDR implementation period.[5]

A key part of the action plan focuses on supporting smallholders by raising awareness about the law, collecting their geo data, and covering the costs for them to legalize their operations and enter their information into the system. This will ensure their products are traceable and compliant when the law comes into force.

Private sector leads but risks leaving some behind

European coffee traders and roasters are hurrying to set up systems for EUDR compliance, using satellite imagery, artificial intelligence, and on-the-ground verification to track deforestation among their suppliers.[6] Third-party verification agencies catering to the coffee sector have also launched new EUDR-related initiatives, including:

- a compliance program from the commodities marketplace, the Intercontinental Exchange;

- an updated coffee sustainability standard from Fairtrade International;

- a compliance service from the baseline sustainability certifier 4C; and

- additional EUDR criteria introduced in the Rainforest Alliance standard.

Within Ethiopia, several business associations have been organizing awareness-raising events to ensure their members know that the EUDR is coming and advising them on steps they can take.

Nevertheless, not all coffee producers are being reached by these private sector initiatives. Coffee sustainability analysts warn that despite the clear legal responsibility for compliance falling on traders, roasters, and retailers within the EU, there is a significant risk that industry actors shift costs, obligations, and administrative burdens onto small-scale farmers to access the European coffee market.[7]

Development partners are helping with a just transition

With Dutch funding through the Netherlands Trust Fund V (NTFV) project (a four-year partnership (July 2021- June 2025) funded by the Ministry of Foreign Affairs of the Netherlands to support micro, small and medium-sized enterprises in the digital technologies and agribusiness sectors), the International Trade Centre (ITC) has led the development of a National Action Plan together with the Ethiopian Coffee and Tea Authority (ECTA). The action plan includes a policy analysis, and a risk level analysis to understand the country's standing, collecting geo data to identify the coordinates of coffee farms and conducting on the ground verification. Most of these activities have been initiated by the Ethiopian Coffee and Tea Authority with the support of development partners. By raising awareness and setting up a stakeholder dialogue platform that includes key actors, ITC and ECTA have outlined joint actions to ensure compliance with the new EU regulations. ECTA has now set up a taskforce to work on the EUDR as well as the European Corporate Social Due Diligence Directive (CS3D). ITC is also directly supporting Ethiopian coffee producer organizations and roasters with developing sustainability plans, capacity building, and setting up digital due diligence and traceability systems.

TRAIDE Foundation, in partnership with ITC, organized a trade mission for Dutch coffee traders and roasters to Ethiopia, aimed at fostering new business connections and providing insights into the the implications of the EUDR on the Ethiopian coffee value chain. By engaging with key stakeholders, such as producer unions and the ECTA, the participating companies gained a clearer understanding of compliance with EU regulations and opportunities for collaboration. Several companies are now implementing traceability systems in collaboration with Ethiopian producers.

You can watch a video on this Coffee Trade Mission Ethiopia 2023.

Towards a traceable coffee sector

Many questions remain about the implementation of the EUDR. There is a need for detailed information about the specific obligations each stakeholder in the coffee value chain (producers, processors, exporters, and importers) must meet to comply with the EUDR. What documentation and evidence must be provided at each stage of the value chain? How frequently must compliance be demonstrated? How should each value chain actor address and rectify instances of deforestation?

The Ethiopian Government needs to speed up the roll out of its action plan and help coordinate coffee actors. Some are calling for a national traceability system. However, this requires significant time and funds. In the meantime, European coffee companies need to co-invest in traceability and due diligence systems for Ethiopian producers to help them become EUDR compliant. EUDR could be a powerful tool to combat deforestation and push the coffee sector to become more sustainable. Different stakeholders need to work together to ensure this does not come at the cost of the most vulnerable or cause Ethiopia to disengage from the European market.

‘European coffee companies need to co-invest in traceability and due diligence systems for Ethiopian producers in order to help them become EUDR compliant’

More information

Would you like more information on the EUDR and how it will impact the Ethiopian coffee sector? Please go to the country page of Ethiopia at the website Agroberichtenbuitenland.nl of the Dutch Ministry of Agriculture, Nature and Food Quality. You can also send an e-mail to the agricultural team at the Dutch Embassy in Addis Ababa: add-lnv@minbuza.nl.

[1] https://amp-theguardian-com.cdn.ampproject.org/c/s/amp.theguardian.com/global-development/2024/apr/09/coffee-how-rules-made-in-europe-put-ethiopian-farmers-at-risk.

[2] Ibid.

[3] https://www.reuters.com/markets/commodities/coffee-firms-turning-away-africa-eu-deforestation-law-looms-2023-12-19/.

[4] https://www.ena.et/web/eng/w/eng_3982888.

[5] https://addisstandard.com/news-ethiopia-seeks-extension-for-implementation-of-eu-deforestation-free-regulation/#:~:text=Adopted%20by%20the%20European%20Parliament,compliance%20and%20sustainable%20resource%20management.

[6] https://dailycoffeenews.com/2024/02/13/jde-peets-and-enveritas-announce-global-deforestation-free-plan/.

[7] https://coffeebarometer.org/documents_resources/coffee_barometer_2023.pdf, p. 43.

This article is part of the 11th edition of the e-magazine Agrospecial titled "Impact of EU Deforestation Regulation worldwide" (originally published on June 5, 2024).

In this Agrospecial, the Netherlands Agricultural Network showcases the opportunities and challenges associated with the EUDR from the perspective of the LAN teams. They introduce us to their related work, provide insights into what is happening in their respective countries, and showcase examples of projects and actions the LAN is taking in promoting sustainable supply chains and responsible business conduct. Once again, cooperation is key, the LAN plays a crucial role in this work.